34+ can i write off mortgage interest

Ask a Tax Expert for Info Now About How to Write-Off Mortgage Interest in a Private Chat. Web Basic income information including amounts of your income.

425 E Brockway Ave Morgantown Wv 26501 Mls 10147227 Trulia

Web Homeowners in Seattle or Denver should know that as of 2018 the limits on qualified home loans were lowered.

. Web Youre allowed to deduct the interest on a loan secured by your main home where you ordinarily live most of the time and a second home. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. For taxpayers who use.

The terms of the loan are the same as for other 20-year loans offered in your area. Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. For married taxpayers filing a separate. As of the beginning of 2018 couples who file their.

In addition to itemizing these conditions must be met for mortgage interest to be deductible. You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage to. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web You cant deduct the principal the borrowed money youre paying back. Web The official line of the Canadian government is that you can deduct the interest you pay on any money you borrow to buy or improve a rental property.

Web What is the home mortgage interest deduction. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

A mobile home RV house trailer or. Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. Married filing jointly or qualifying widow.

The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a. You may still be able to. Single or married filing separately 12550.

Ad Chat Online Right Now with a Tax Expert and Get Info About Tax-Deductible Donations. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Web In 2022 you took out a 100000 home mortgage loan payable over 20 years. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. Web If your home was purchased before Dec.

Web For 2021 tax returns the government has raised the standard deduction to. You paid 4800 in.

How To Test Banking Domain Applications A Complete Bfsi Testing Guide

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Bankrate

Mortgage Statement 10 Examples Format Pdf Examples

Stevesellsdfw S Blog Don T Just Read Write Something

Ex 99 1

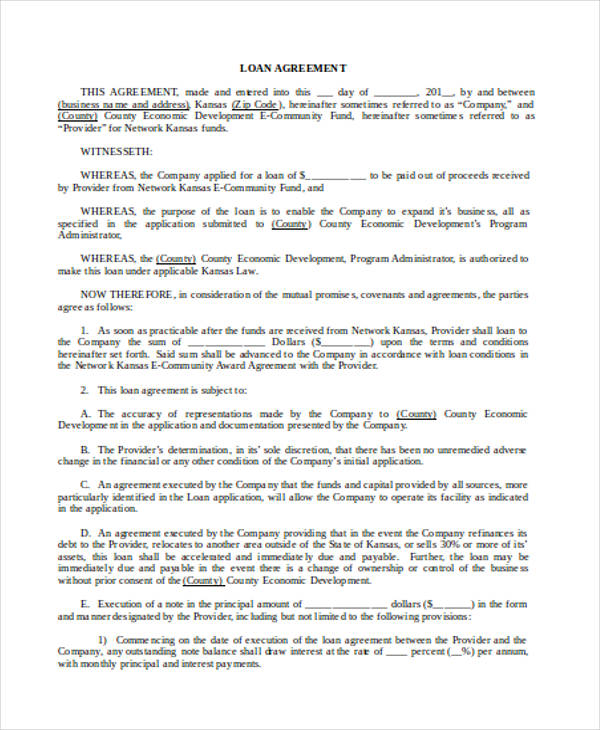

Free 34 Loan Agreement Forms In Pdf Ms Word

Ex 99 1

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Bankrate

Free 34 Loan Agreement Forms In Pdf Ms Word

Ex 99 1

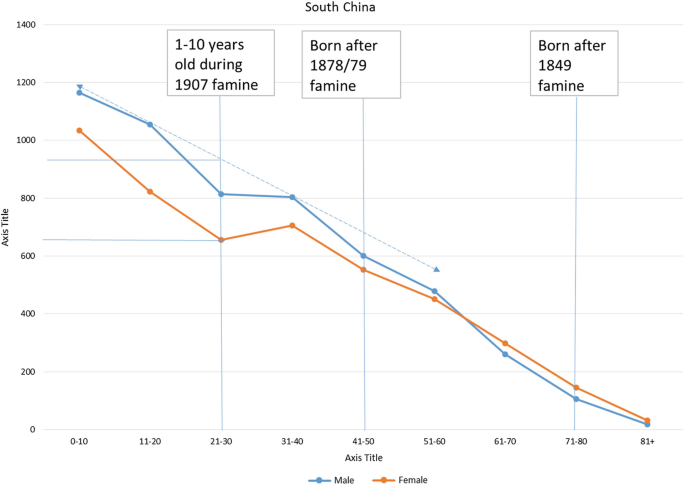

The China International Famine Relief Commission Springerlink

A Helpful Tax Write Offs List For 1099 Contract Dance Teachers Special Thanks To Financialgroove Com For Pr Dance Teacher Teacher Supplies List Dance Teachers

604 Arlington St Morgantown Wv 26501 Mls 10147137 Trulia